A Recap Of The Most Exciting Updates From The Market, How I’m Playing It, Thoughts And What I’ve Been Up To.

Yoooo, it's been a not-so-long break. I wouldn’t say it has been a break entirely because I’ve been involved in acquiring a skill while knowledge hunting on the side. Got a lot to say but before I dive in fully I’ll love to drop my two cents about the Wassieverse failure and the Webaverse wily success.

Wassieverse

About 914 minted out of 13k supply for a mint price of 0.3 eth, with a floor price of 0.2eth? A massive and expected failure I must say.

I’d say Wassieverse failed solely due to the mint price to supply ratio. To start with, we are in a bear market and this affects the availability and circulation of liquidity. For a supply as large as 13k, the mint price should have been lesser. A low mint price would have made it possible for more individuals to invest in the project.

“What of Webaverse?” you might be thinking. Webaverse minted 12.2k out of 20K supply for 0.2 eth($346 currently) with a floor price of 0.68 eth. Well, it seems the perceived success of Webaverse is a result of wash trading. The supply to owners’ ratios is not equivalent to the volume. I also noticed that money was being sent out of the mint contract while mint was ongoing. It appears that the removal of these funds was used for wash trading.

$OP PROTOCOLS and GRANT

$OP is a layer 2 solution. Some protocols built on optimism(Layer 2) have put out proposals to the Optimism governance in a bid to receive grants. These grants would be sent out to the protocols in the form of $OP tokens if/ when the proposals are accepted.

Here’s a list of protocols that are set to get the $OP grant gov.optimism.io/t/voting-cycle… Reading this would help you learn more about the protocols and the grant.

Now, this is how I’m getting involved in the development:

Most of these protocols have their native tokens and I think the best way to play it is by buying these native tokens before the protocols receive the grant.

For instance, I bought the $Thales native token before the grant was accepted. The token pumped by 30% as soon as the Optimism governance announced the acceptance of $Thales on Twitter. $Aelin token pumped by 15% following the same pattern.

So I’ll advise buying the native tokens early in the case where a protocol has one.

ETH 2.0 and the Merge:

The long-awaited ETH 2.0 is almost here. ETH 2.0 is a new version of the Ethereum blockchain that would implement the proof of stake consensus mechanism to verify transactions via staking. With the merge, the proof of stake consensus would replace the previous proof of work technique which required Ethereum miners to use high voltage of electricity to process transactions.

Validators would replace miners and be eligible to participate in the proof of stake consensus.

A validator is required to stake up to 32 ETH and more. The option of engaging in validation duties would be available through the algorithm. The amount of Ethereum staked by a validator determines how frequently they are able to produce blocks, which in turn determines how much the validator would be rewarded in Ethereum.

The practicality of this development is that the validators with the most staked amounts of Ethereum get to earn more than the average validators, leaving the regular/average validators with crumbs of profit after staking.

This brings me to say, PoS is a plutocracy, and with EIP-1559, it will give the biggest holders the possibility to accumulate faster than anyone else, by doing nothing but staking which brings about some form of centralization.

The merge testnet (Goerli Testnet) launched earlier this week. The Merge is set to launch by the 15th/16th of September and I presume there would be a rise in the value of Eth before the launch.

Arbitrum

Arbitrum is also a layer 2 solution like Optimism. There have been rumors about a likely airdrop of Arbitrum’s native token, $ARBI as a means of incentivizing its users.

As it currently stands, no one truly knows the requirements for eligibility. But I suspect it might be linked to the Arbitrum odyssey tasks, the arbitrum guild and the bridge.

The Arbitrum odyssey event is an eight-week event but it’s paused at the moment. There’s a possibility that users who completed the tasks will be eligible for the airdrop.

Arbitrum has been on the good side since it launched and the Arbitrum One Mainnet(Arbitrum Beta) will be migrated to the Arbitrum Nitro chain on the 31st of August. The odyssey tasks would continue right after the migration.

Arbitrum Guild

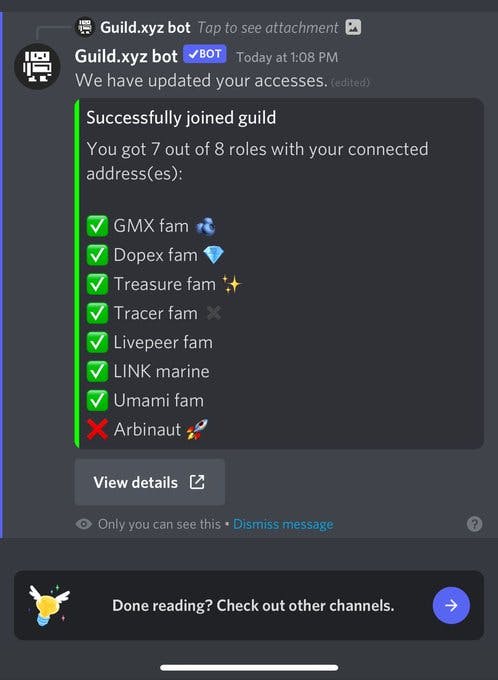

To be a part of the Arbitrum guild, participants are required to have completed at least 1 out of the 8 odyssey tasks, or hold at least either 0.001 worth of $MAGIC, $GMX, $DPX tokens( or DPX NFT) in the first step. Join here: t.co/AqQ8k4qHMp

The next step is to join the Arbitrum discord and verify the wallet containing any of the above tokens.

Once these steps have been completed, the participant becomes a part of the guild.

Arb Discord: t.co/jVaZ9l1f7H

Personally, I’ve done all the tasks except the required one for $Arbinaut ( I’ll complete it when the odyssey tasks resume)